Standard Chartered Bank Singapore launches Singapore’s first interactive payment card, or security token card, using MasterCard’s Display Card technology. This will make it convenient and secure for customers without having to carry around another security device .

You are probably familiar with the One-Time Password authentication token or device with the online banking service that comes with your banking account.

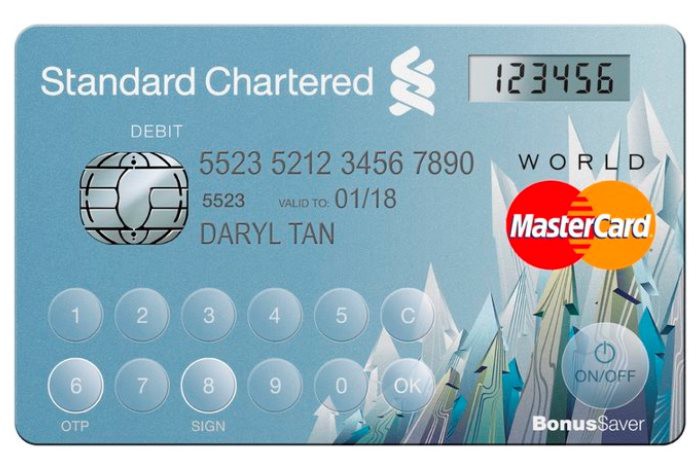

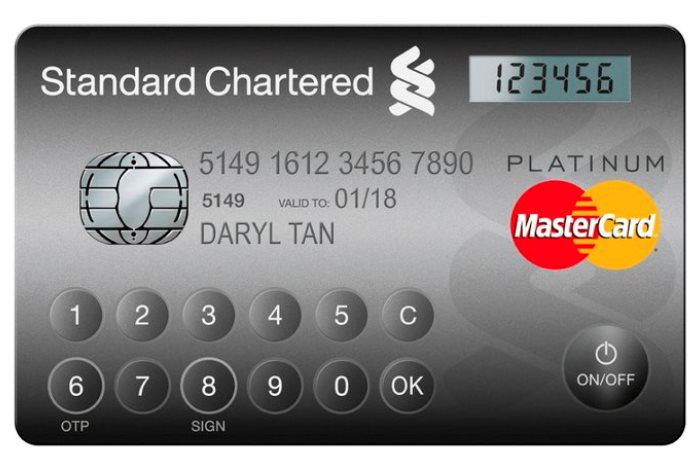

The MasterCard Display Card, manufactured by NagraID Security, works like a regular credit, debit or ATM card that combines an embedded LCD display and touch-sensitive buttons that allows you to generate a One-Time Password (OTP) as an authentication security measure.

Future card functionality may be able to indicate real time information such as available credit balance, loyalty or reward points, recent transactions, and other interactive information.

Starting next year, all Standard Chartered Online Banking or Breeze Mobile Banking users will use the Standard Chartered security token card as a new personal security device for higher-risk transactions.

Matthew Driver, president, South East Asia, MasterCard Worldwide said: “MasterCard is pleased to have been able to support the launch of Singapore’s first Display Card by Standard Chartered. With the continued growth in online and now mobile initiated remote payments, consumers are naturally demanding increased security. The innovative features of the Display Card serve to address this need, whilst empowering consumers to do so much more with their payment cards.”

All MasterCard Platinum and Bonus$aver credit cards as well as MasterCard Super Salary, XtraSaver, Bonus$aver debit cards issued in Singapore will now be Display cards.